32+ fed rate vs mortgage rate chart

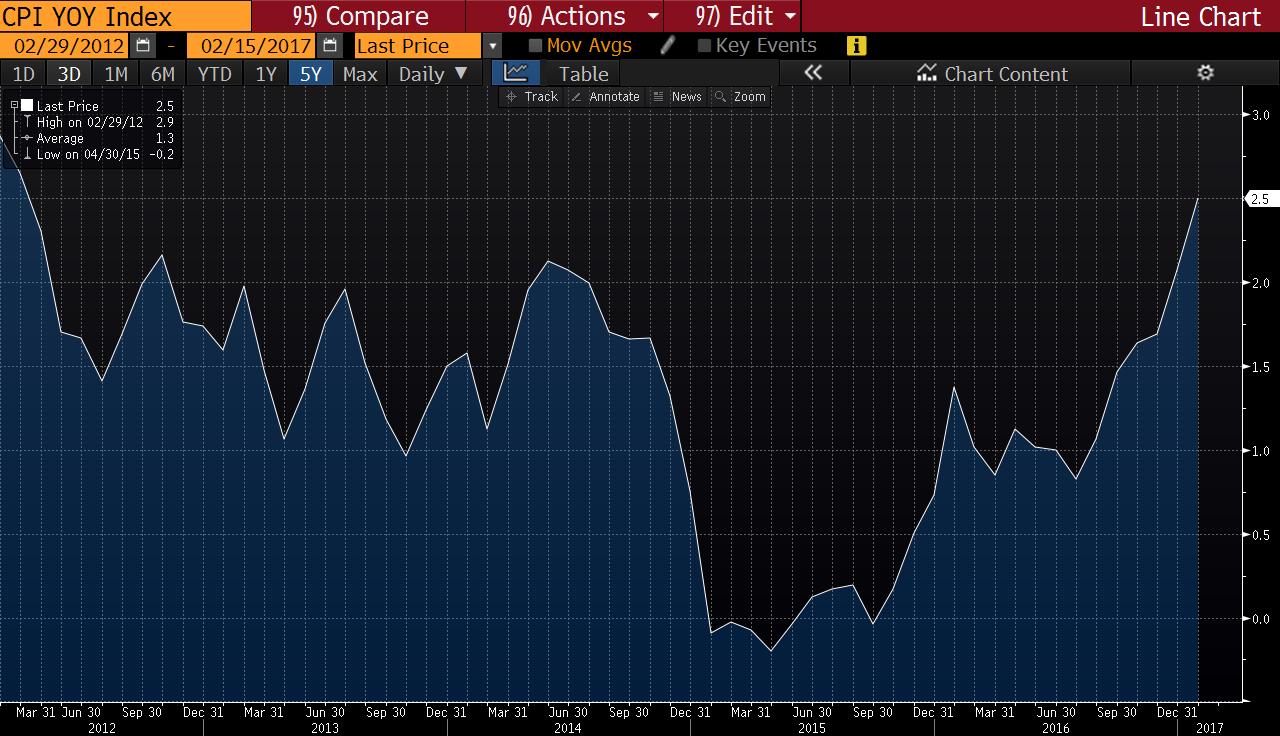

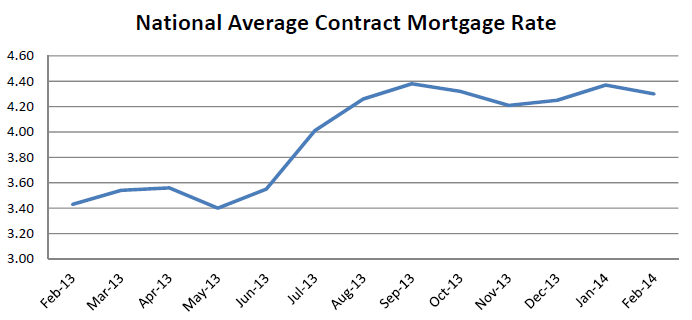

Web The average ARM rate according to Freddie Mac has ranged from 273 to 312 this year through March 8. In the chart above its clear that directionally all rates tend to follow the.

Kbnztw80m9evhm

When futures markets foresee lower.

. Primary Mortgage Market Survey. Loan-to-Value Greater Than 80 FICO Score Between 720 and 739 Percent Daily Not Seasonally Adjusted 2017-01-03 to. 30-Year Fixed Rate Mortgage Average in the United States MORTGAGE30US Source.

Web The lowest historical mortgage rates in history for 30-year FRMs were more recent than you might think. Web 30-Year Fixed Rate Conforming Mortgage Index. Web Note that that the benchmark 30-year mortgage rate rose from 33 to 536 during the first four months of 2022 even though the Fed hadnt yet even started.

Web FRED now offers Optimal Blue Mortgage Market Indices which provide a more-detailed look at mortgage rates. Its mostly been flat with a couple of spikes. These indices are computed daily from actual.

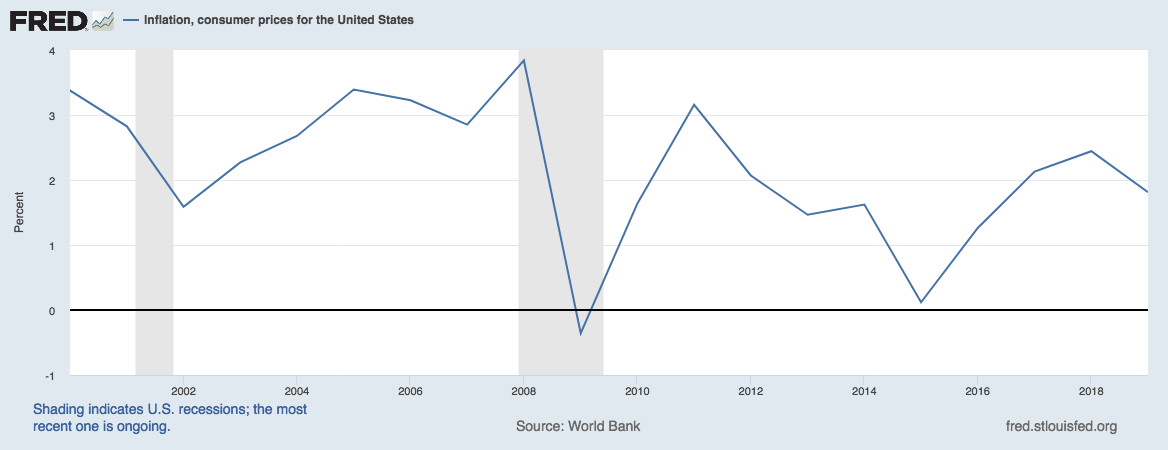

The current situation is much closer to the scenario. Web The average 30-year fixed mortgage rate tracks the 10-year Treasury yield running roughly in parallel but higher. Web The rate governs how much banks pay each other in interest to borrow funds from their reserves kept at the Fed on an overnight basis.

Web When the fed funds rate changes one bank will usually take the lead and announce a change in that banks prime rate that same day The prime rate moves only. Web Federal Funds Rate vs Mortgage Rates vs Interest on Deposits vs 1-Year Treasuries. The current federal funds rate as of March 02 2023 is 457.

Web The short answer. December 2020 saw mortgage rates hit 268 according. Web The Federal Open Market Committee FOMC meets eight times a year to determine the federal funds target rate.

Web The federal funds rate is the interest rate at which depository institutions trade federal funds balances held at Federal Reserve Banks with each other overnight. The Fed kept this rate set near. Often credit markets react before the Fed intervenes.

Web As the Fed funds rate rises interest rates including mortgage rates tend to follow. Web The federal funds rate is the interest rate at which depository institutions trade federal funds balances held at Federal Reserve Banks with each other overnight. This graph contrasts the movements of the weekly average Federal Funds rate against the movements of the weekly 10-year Treasury Constant Maturity.

Web As of today March 7 2023 the benchmark 30-Year Fixed mortgage rate is 704 FHA 30-Year Fixed is 678 Jumbo 30-Year Fixed is 615 and 15-Year Fixed.

Ocpyp5614q0fbm

30 Year Fixed Rate Mortgage Average In The United States Mortgage30us Fred St Louis Fed

Mortgage Rates Fall Back In February Eye On Housing

How Does The Fed Rate Affect Mortgage Rates Yoreevo

Economist S View Survey Of Long Term Interest Rates

A 4 Mortgage Rate Use These Mortgage Charts To Easily Compare Monthly Payments Fast

Chart Fed And Ecb Keep Interest Rates Steady Statista

Mortgage Interest Rates Remain Low 02038 Real Estate

Economist S View The Disingenuous James Bullard

Mortgage Rates Vs Fed Announcements

Treasury Market Had A Cow Mortgage Rates Jumped Wall Street Crybabies Clamored For Help But The Fed Smiled Satisfied Upon Its Creation Wolf Street

Mortgage Applications Drop Despite Lower Mortgage Rates Industry Is Baffled Wolf Street

Mortgage Rates Could Drop To Under 3 Due To Fed Bond Buying

New Fed Policy Could Mean Years Of Low Mortgage Rates Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Public Affairs Detail Federal Housing Finance Agency

Economist S View The Mankiw Rule Today

A 4 Mortgage Rate Use These Mortgage Charts To Easily Compare Monthly Payments Fast